RBC Global Asset Management announces planned changes to

1 Funds held for less than 30 days are subject to a short-term redemption fee of 1% of redemption value or $45 (whichever is greater) and are in addition to any fee(s) the mutual fund …... RBC does have some index funds with reasonable MERs if you want to stay with RBC. Tangerine's fees are a bit higher, but are easier to manage (one-step purchases, only a single fund to worry about). TD's e-series are a bit harder to set up, but about the same level of complexity as RBC's funds to maintain, with a lower MER if you're interested in switching.

How is buying a Canadian mutual fund also priced in U.S

I’m also an RBC client and opted for the RBC Canadian Gov Bond Index fund as the bond component of my RBC index portfolio because all of the other bond choices are …... RBC does have some index funds with reasonable MERs if you want to stay with RBC. Tangerine's fees are a bit higher, but are easier to manage (one-step purchases, only a single fund to worry about). TD's e-series are a bit harder to set up, but about the same level of complexity as RBC's funds to maintain, with a lower MER if you're interested in switching.

Managed accounts and mutual funds — what’s the difference?

In the Mutual Funds section you should see your existing holding of RBF2010 the RBC investment savings account fund. Under the Actions column, click on the Sell link. To sell some of your units: how to change alignment in excel header Buying a mutual fund without analyzing its holdings is like buying a stock without analyzing its business and finances. Put another way, research on mutual fund holdings is necessary due diligence

The Best Mutual Funds

16/01/2019 · It is an ETF, but ETFs are descendants of mutual funds, so a case can be made that SOXX is one of the best mutual funds for those looking for semiconductor funds to … how to buy a microscope An exchange-traded fund (ETF) is similar to a mutual fund, except an ETF trades like a stock on an exchange. Like a mutual fund, you can buy “units” in an ETF to own a proportional interest of a pool of assets (such as stocks or bonds).

How long can it take?

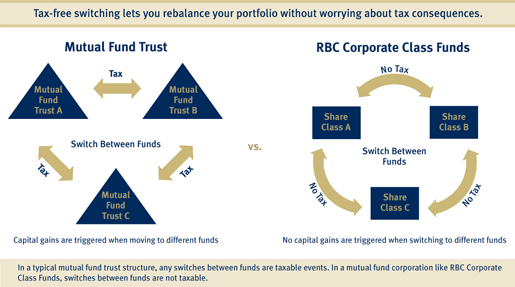

TAXES AND INVESTING IN MUTUAL FUNDS RBC Wealth

- How is buying a Canadian mutual fund also priced in U.S

- Buy RBC Emerging Markets Equity Fund Advice for Investors

- RBC Global Asset Management introduces four new ETFs

- RBC Global Asset Management Mutual Funds

How To Buy Rbc Mutual Funds

A new year, thank goodness - January 2019. Eric Lascelles, Chief Economist, RBC Global Asset Management, shares the latest views on the global economy and …

- Enter our first contender in this comparative series: RBC's family of mutual funds. I'll focus on funds from four broad categories: Canadian fixed income, Canadian equity, U.S. equity and

- Essentially, you're buying a mutual fund with all of its compensation for investment advisers and dealers (called a trailing commission) stripped away except for a rump of 0.25 per cent in most

- Buying units or shares of a mutual fund is similar to buying shares of a company. Essentially, each unit you own is a portion of the combined investments owned by the fund. Each unit has a specific value that varies from day to day depending on the value of the investments in the fund. The term used to define this value is Net Asset Value Per Share (NAVPS) and the formula used to calculate the

- While each RBC ETF is a mutual fund under the securities legislation of certain provinces and territories of Canada, the RBC ETFs have received exemptive relief from certain provisions of Canadian securities legislation applicable to conventional mutual funds.