Closing Entries and the Postclosing MCCC

Income Summary [ 5 Answers ] I am not looking for the answer that's why I have not included the dollar amount. I just want to know how to do the income summary to the question below.... Close Income Summary. Date Accounts and Explanation Debit Credit Mar. 31 Income Summary 98,400 Clos. (3) Brentwood, Capital 98,400 To close Income Summary.

If a business has a net income for the period the journal

CLOSING PROCEDURE The Four Steps 1. Close revenue account(s) into Income Summary 2. Close expense account(s) into Income Summary 3. Close Income Summary into Capital... To Close Income Summary to Capital. Dividing Net Income Using a Fixed Ratio In the partnership agreement, the contract may specify a fixed ratio to be used to divide the profits or losses. For example, Saar, Loretto, and Abdullah decide to use a ratio of 3:2:1, respectively. To use this ratio, convert the ratio into a fraction and multiply it by the net income or loss of the period. The steps

Unclear on Year-end procedures Manager Forum

First, the revenue accounts are closed to the income summary account. Second, the expense accounts are closed to the income summary account. At this point, the income summary account will equal the profit or loss for the period. Third, the income summary account is closed to the owners' equity account or retained earnings. Lastly, any distributions to owners are closed into the equity account. how to delete items factorio If you have a net loss the income summary will have a debit balance, so you can debit retained earnings and credit income summary to close it out. This will reduce retained earnings as …

Closing Journal Entries BlackLine Magazine

whenever there is a net income the income summery account will have a credit balance and if there is a net loss the income summery account will have a debit balance. therefore, when i come to answer your question so as to close the balance of the income summery and increase the owners equity you must do the following journal entry how to bring itmes closer togethor in bootstrap First, the revenue accounts are closed to the income summary account. Second, the expense accounts are closed to the income summary account. At this point, the income summary account will equal the profit or loss for the period. Third, the income summary account is closed to the owners' equity account or retained earnings. Lastly, any distributions to owners are closed into the equity account.

How long can it take?

CLOSING ENTRIES gato-docs.its.txstate.edu

- How to record partnership reports (net income) Accounting

- Which accounts get closed at the end of a fiscal year

- Closing Entries and the Postclosing MCCC

- The 1. Close revenue account(s) into Income Summary Four 2

How To Close Income Summary

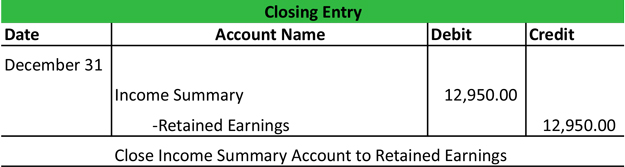

Closing entries are used to close out (or bring the balance to $0) temporary accounts (nominal accounts) to Retained Earnings. Basically, closing entries are journal entries to transfer the nominal accounts to the real accounts. For the accounting period being closed, temporary accounts are: revenue, expense, income summary and dividends paid

- Closing Entries. Closing entries are used to close out (or bring the balance to $0) temporary accounts (nominal accounts) to Retained Earnings. Basically, closing entries are journal entries...

- Revenues total 10200 expenses total 7300 and the owners withdrawals account has a balance of 2600 What is the balance in the income summary account prior to closing net income or net loss?

- Step 1: Close Credit Balances in Revenue Accounts to Income Summary transfers credit balances in revenue (and gain) accounts to income summary account Step 2: Close Debit Balances and Expense Accounts to Income Summary

- CLOSING PROCEDURE The Four Steps 1. Close revenue account(s) into Income Summary 2. Close expense account(s) into Income Summary 3. Close Income Summary into Capital